Truthout: “This means that public sector workers across the country have pension funds invested with a hedge fund that refuses to do right by farmworkers, some of the poorest and most vulnerable laborers in the U.S.”

In a searing new article published yesterday in the news blog Truthout, reporter Derek Seidman, a research analyst with the Public Accountability Initiative, takes a closer look at the activist investor who runs Wendy’s, Nelson Peltz, and at Peltz’s $11-billion dollar hedge fund, Trian Partners. And what he finds might just surprise you.

Following on last month’s major New York Times article on the CIW’s Wendy’s Boycott, the Truthout report is a must-read look behind the curtains of a fast-food corporation that refuses to open its supply chain to the Fair Food Program’s award-winning audits and complaint investigation process, something Wendy’s chief competitors agreed to do over a decade ago. Writing, “One big fact the Times article failed to note is that the real power behind Wendy’s is a prominent hedge fund run by a well-known Trump donor who owns a $123.1 million Palm Beach estate,” Seidman takes the reader inside Nelson Peltz’s exclusive world of private jets and massive mansions, and lays responsibility for Wendy’s unconscionable refusal to join the Fair Food Program squarely at Peltz’s feet. The 2,500-word article sums up its argument in a compelling final paragraph:

The CIW’s effort to pressure Wendy’s to participate in the Fair Food Program is not just a battle between farmworkers and a major fast food chain. It is a battle that pits Florida’s tomato pickers against the Wall Street firm that oversees Wendy’s, which is run by a billionaire who has piles of cash to give to politicians like Donald Trump but who refuses to pay an extra penny per pound of tomatoes so that farm laborers can have better wages, safer working conditions, and more dignity at work.

But the article’s analysis doesn’t stop at Peltz and Trian Partners. Instead, it follows the money one step further, laying bare the connections between some of the country’s largest public employee pension funds – including the California State Teachers’ Retirement System and the New York State and Local Retirement System – and Peltz’s investment firm, concluding:

This means that public sector workers across the country have pension funds invested with a hedge fund that refuses to do right by farmworkers, some of the poorest and most vulnerable laborers in the U.S.

You can find the Truthout article here in its entirety. Below, you can find several extended excerpts from the story that connects the dots between billionaire investors, the public employee pension dollars that fund their investments, and the battle to end generations of farmworker poverty and abuse that is gaining momentum every day, from college campuses to the pages of this country’s most widely-read newspapers.

************************

On the CIW’s Wendy’s Boycott and Nelson Peltz/Trian Partners:

Since January 2013, the Coalition of Immokalee Workers (CIW) has been mounting an effort to pressure Wendy’s to participate in its Fair Food Program, which ensures better wages and safer working conditions for Florida’s tomato pickers. The CIW has been organizing in Florida for over two decades, and its efforts have been widely recognized for improving the lives of thousands of farmworkers.

The New York Times noted in a recent article that the CIW “has persuaded companies like Walmart and McDonald’s to buy their tomatoes from growers who follow strict labor standards,” but that “high-profile holdouts have threatened to halt the effort’s progress.” The CIW is now “raising pressure on one of the most prominent holdouts — Wendy’s — which it sees as an obstacle to expansion.” The CIW and its supporters have launched a campaign to get officials at colleges campuses with Wendy’s restaurants to “either remove the chain from campus or block it from doing business there in the future,” according to the Times.

One big fact the Times article failed to note is that the real power behind Wendy’s is a prominent hedge fund run by a well-known Trump donor who owns a $123.1 million Palm Beach estate that sits next to one of Trump’s former properties…

On Peltz’s hedge fund, Trian Partners:

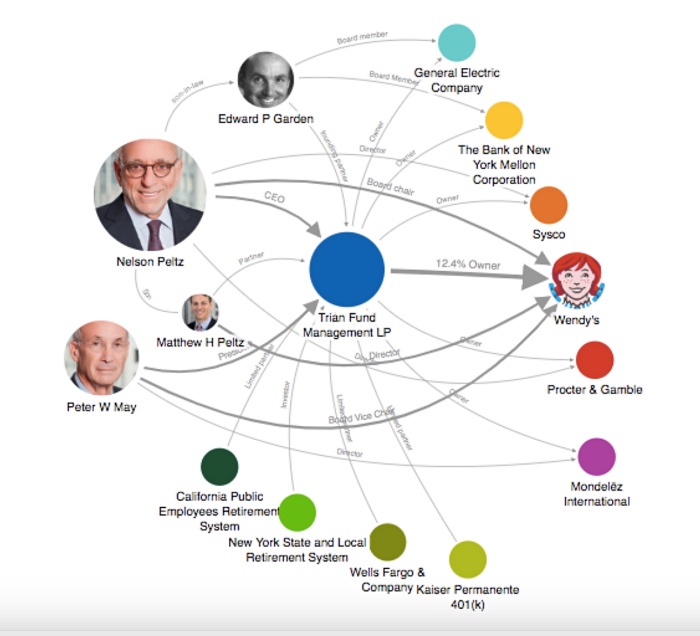

Trian Partners is a Wall Street power player that oversees $11 billion in assets. Its CEO is Nelson Peltz, a famous billionaire investor. Trian Partners has a 12.4 percent ownership stake in Wendy’s, and Peltz and Trian’s two other co-founders also have significant personal holdings in the company. The fast food chain is one of the hedge fund’s prized portfolio companies.

Trian and Peltz are not passive owners of Wendy’s. Peltz has a reputation as a hands-on, activist investor in his companies. He is Wendy’s board chair, and Peter May, Peltz’s longtime partner and Trian’s president and co-founder, is the vice chair of Wendy’s board. Peltz’s son Matthew also sits on the board of Wendy’s. Trian has been invested in Wendy’s since 2005.

Trian has a 12.4 percent stake in Wendy’s, according to a March 12, 2019 Barron’s article. The article also states that “Peltz himself has total ownership of 44.4 million Wendy’s shares, including shares held by Trian, for a 19.3% stake.” Additionally, according to a recent SEC filing that the Barron’s article cites, May and Garden also hold significant sums of Wendy’s shares. More shares are held through family members of and foundations affiliated with Trian executives.

Trian describes itself as a “highly engaged shareowner, bringing an ownership mentality to public market investing.” It takes active board positions with the companies it acquires. “We look for fundamentally great companies where management has gone off track operationally and where we think we understand what it takes to get the business back on track,” Garden told an investment conference in March 2019…

On Trian’s public employee pension fund partners:

Institutional investors, such as retirement funds, foundations and endowments account for 75 percent of Trian’s assets, according to Fortune. For example, as of June 2018, the California State Teachers’ Retirement System had a $895 million limited partnership with Trian, while, in 2018, it appears that the New York State and Local Retirement System paid Trian a total of $21.46 million in fees to oversee $618 million in investments.

This means that public sector workers across the country have pension funds invested with a hedge fund that refuses to do right by farmworkers, some of the poorest and most vulnerable laborers in the U.S.

According to PitchBook, a database of information on private equity, Wells Fargo’s corporate pension and Kaiser Permanente’s 401(k) fund, as of January 30, 2017, and January 30, 2018, respectively, also have limited partnerships with Trian…

On Nelson Peltz’s personal wealth and lifestyle:

Nelson Peltz is the CEO and public face of Trian Partners. His net worth is $1.6 billion.

Peltz sits on the corporate boards of Wendy’s, Procter & Gamble, Sysco and the Madison Square Garden Company, and he has sat on a host of other corporate boards in the past.

Peltz has a reputation for his opulent lifestyle and lavish spending. He owns the second most expensive property in Palm Beach, Florida — a huge oceanfront estate worth $123.1 million, according to the Florida Department of Revenue. The estate, called Montsorrel, neighbors a property previously owned by Donald Trump.

Peltz also owns a 27-room mansion on a 130-acre property in Bedford, New York, that in 2009 was reported to feature “a lake, waterfall, indoor hockey rink with Zamboni machine, and a flock of albino peacocks that can occasionally be seen running around the manicured grounds.” He has been reported to own two matching jets, and he used to take a private helicopter to work before his neighbors in the Town of Bedford, upset with the noise, succeeded in stopping him.

In 2016, Peltz also threw a $2 million bar mitzvah party for his twin sons at New York’s Pierre Hotel. Town & Country featured a story on it with the headline: “Is This the Most Over-the-Top Bar Mitzvah Ever?”

Peltz has faced controversy over his lifestyle. A 2009 report profiled his Bedford mansion as a “house of horrors.” “According to a source with knowledge of life inside the Peltz household,” the report said, “employees of the estate live in terror as they tend to the billionaire and his third wife, a former model with whom he has eight kids.” It went on:

In one of the most egregious incidents, we hear Mrs. Peltz summoned a butler to the master bathroom after she discovered drops of urine on the toilet seat. She demanded the butler clean it up, which he did, although she then insisted that he clean the toilet seat again. And again. It was only after he’d cleaned the seat four times — “once more for luck,” she said — that Mrs. Peltz, perhaps detecting some frustration on the butler’s part, informed him that she didn’t like his attitude and dismissed him. It was Easter Sunday…

Seidman’s conclusion:

In many ways, the Coalition of Immokalee Workers has been an ongoing success story. After its start in 1993, it succeeded in gaining a national profile and in pressuring some of the biggest retailers and chain restaurants in the world to participate in its Fair Food Program. As the New York Times notes:

The Immokalee workers’ initiative, called the Fair Food Program, currently benefits about 35,000 laborers, primarily in Florida. Over the last decade, it has helped transform the state’s tomato industry from one in which wage theft and violence were rampant to an industry with some of the highest labor standards in American agriculture.

“They’ve already been successful in a measurable way at effectively eliminating modern-day slavery and sexual assault, and greatly reducing harassment,” said Susan L. Marquis, dean of the Pardee RAND Graduate School in Santa Monica, Calif., who has written a book on the program. “Pay is substantially higher for these people.”

But the Fair Food Program is now being threatened by Wendy’s and Trian Partners’ refusal to participate.

The recent New York Times article said that after 2014, Wendy’s started importing most of its tomatoes from Mexico, “where forced labor and physical abuse are common.” According to the CIW, last year, Wendy’s announced its plan to “bring tomato purchases back to U.S.,” but did not commit to the Fair Food Program.

The CIW’s effort to pressure Wendy’s to participate in the Fair Food Program is not just a battle between farmworkers and a major fast food chain. It is a battle that pits Florida’s tomato pickers against the Wall Street firm that oversees Wendy’s, which is run by a billionaire who has piles of cash to give to politicians like Donald Trump but who refuses to pay an extra penny per pound of tomatoes so that farm laborers can have better wages, safer working conditions, and more dignity at work.

You can read the Truthout article in its entire here.